TrendCompass Reports

TrendCompass delivers daily CTA trend following signals for investors, traders and hedgers. TrendCompass is powered by the I-System© whose reliability and effectiveness have been proven through daily use since 2003 and a stellar performance track record in the hedge funds industry.

Simplicity and excellent results

“After having spent countless hours in attempting to develop my own trend following system, I discovered Trend Compass. The simplicity in following the trading recommendations and the excellent results allows me to use this system as my primary investing approach. I do not fear missing any large trends and feel comfortable using this system in any market environment with the majority of my investment capital.” – Dr. Fred Francis, Independent Investor

Contents of this page

Markets move in trends

The ultimate in quality support for investors and traders

Active investors have a strong tendency to underperform market benchmarks or even lose money. An 11-year study conducted by the UK Financial Conduct Authority found that as many as 80 percent of all retail investors lose money. Do not let your portfolio become a statistic! There is a better way: with systematic trend following you can turn your investing into a life-long success.

This all is in spite of the fact that since 2009, we have enjoyed the longest stocks bull market on record! Clearly, investors need a better approach. With systematic trend following you can turn your investing into a life-long success.

Invest successfully for life with systematic trend following

Our daily TrendCompass reports provide quality decision support to help you profit from trends in over 200 financial and commodity markets – with confidence and peace of mind.

I-System: probably the best model of its kind

The reports are powered by the I-System©, whose reliability and performance was proven through daily use since 2003. In fact, we believe that I-System is probably the best trend following model ever built. This is a bold claim – but not a hollow one (click here to see why).

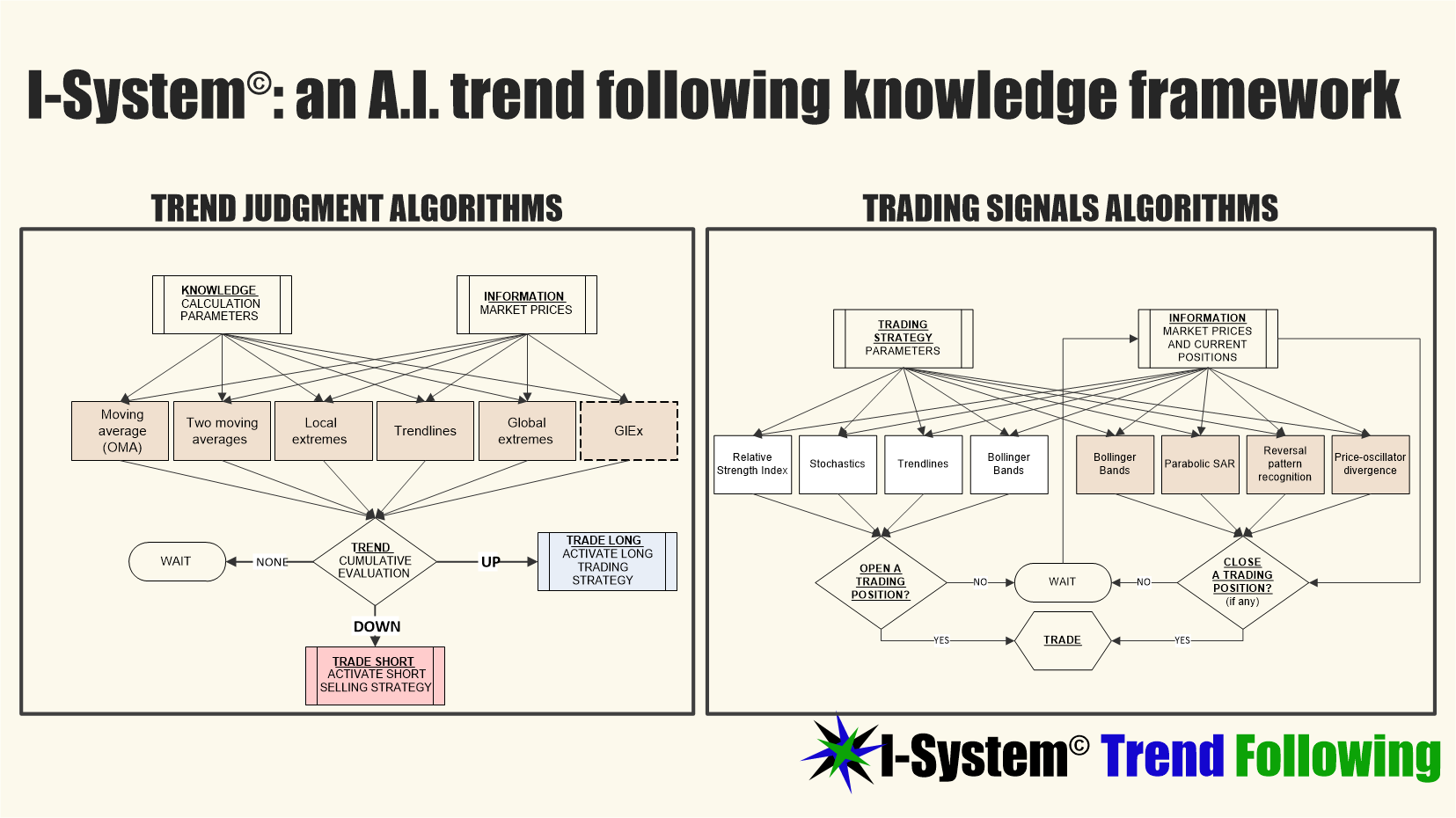

What is the I-System?

I-System comprises a dual neural network of mathematical algorithms that codify a body of knowledge in market analysis and trading.

This robust architecture enables I-System to track thousands of intelligent trading strategies in any security market, generating consistent trading signals with zero loss of quality or focus. Its versatility enables the I-System to simultaneously track long-, short-, and medium-term trends and deploy multiple strategies in any market. This in turn dramatically reduces the model risk often associated with lesser quantitative models.

What we are after: large-scale price events (LSPEs)

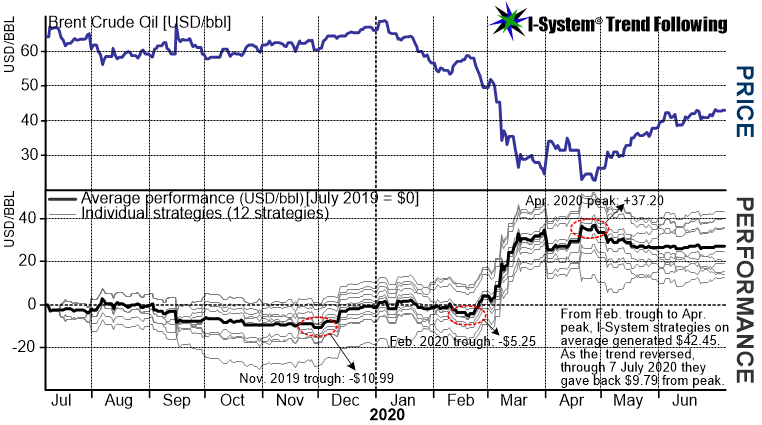

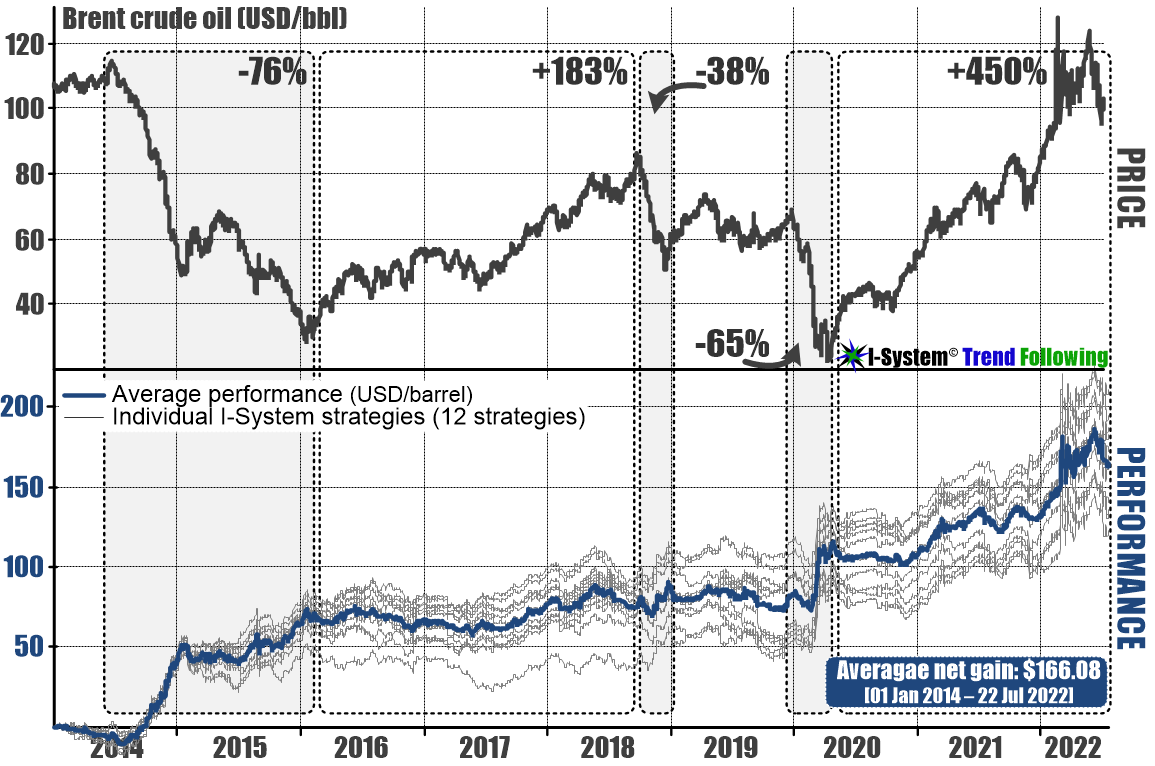

Trend following has proven as one of the most effective investment strategies since the 1970s. That is not to say that it is easy to put in practice. For one thing, trend following can be counterintuitive: while we are naturally inclined to buy low and sell high, trend following entails the opposite – buying securities after their prices have risen and selling them as prices decline. Trend following also requires a great deal of patience and discipline. A good case in point was our experience trading crude oil in 2019/20:

During the oil price collapse in early 2020, I-System strategies generated a profit of $42.45 per barrel, simply through adherence to time-tested set of rules that define how we react to price fluctuations in the market.

The chart above fairly illustrates the nature of trend following: through the entirely unforeseen oil price collapse in the early 2020, I-System strategies generated a profit of over $42/bbl ($42,000 per single crude oil contract) in only two month’s time. However, during the previous 8 months they mostly traded in the negative territory. This is part of the process. The chart below shows our crude oil strategies over a longer time interval:

To profit from a price trend, we need to be in the right position at the right time. This involves risk and incurring some losses until a price trend takes off. But when trends do unfold, the windfalls can be very substantial. Think of prices of Bitcoin, Gold, Oil, S&P 500, Nasdaq 100, or stocks like AMZN, TSLA, MSFT and many others. Whatever you may think about the valuation of those assets, their price appreciation (or decline) invariably unfolded as trends that spanned months or even years, richly rewarding those who were correctly positioned to profit them.

I-System is about long-term reliability, not short-term gimmicks

Many investors would like to find some gimmick providing instant trading gratification and risk-free profits. This desire is met with a flood of offers promising large investment returns, risk-free trading, 80% accurate forecasts, etc. Unfortunately, almost without exception these claims will prove false. This, in part, is the reason why most retail investors lose.

The reasons for poor performance are many but they usually come down to short-term focus, investing with a poorly formulated strategy or no strategy at all and trading too frequently. As Benjamin Graham put it, “The investor’s chief problem – and even his worst enemy – is likely to be himself.”

Achieve life-long success at investing!

The great news is that with a well formulated, effective strategy and discipline you can turn your investing into a life-long success that will steadily enhance your wealth and your quality of life with less stress and with peace of mind. While you’ll have to supply the discipline yourself, we will provide the dependable and effective decision support for your investing thanks to I-System Trend Following and our TrendCompass reports.

In investing, performance is a long-term process

Since the start of our track record in 2007, I-System has consistently outperformed the relevant strategy benchmarks, including world’s top ranked, Blue Chip Commodity Trading Advisors (CTAs).

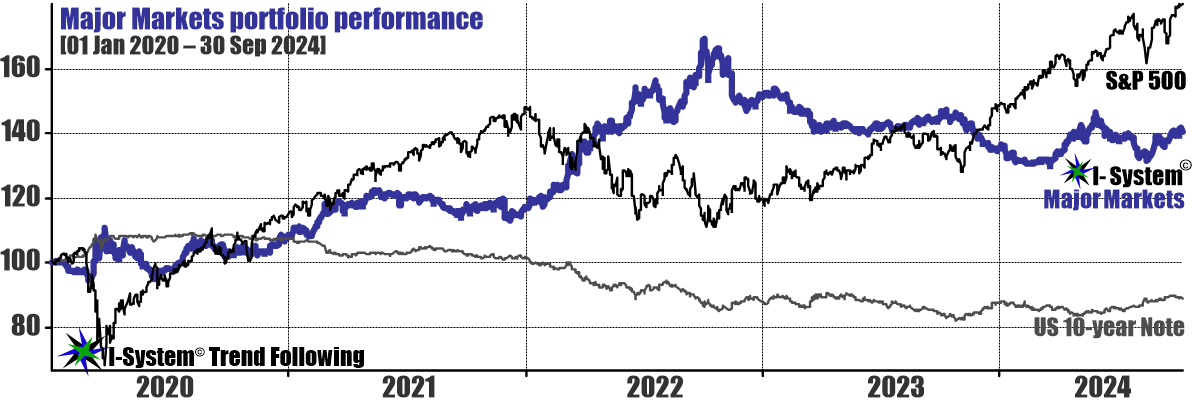

Below is the most recent performance summary of our Major Markets portfolio: 180 trend following strategies covering 15 key global markets including main equity indices, treasury futures, energy, metals, and FX pairs.

A well-diversified trend following portfolio is a robust diversifier; importantly, it provides a non-correlated source of returns as we saw in 2022 and also during the 2020 market turmoil. In both cases, Major Markets portfolio has diverged from adverse trends in stocks and bonds markets.

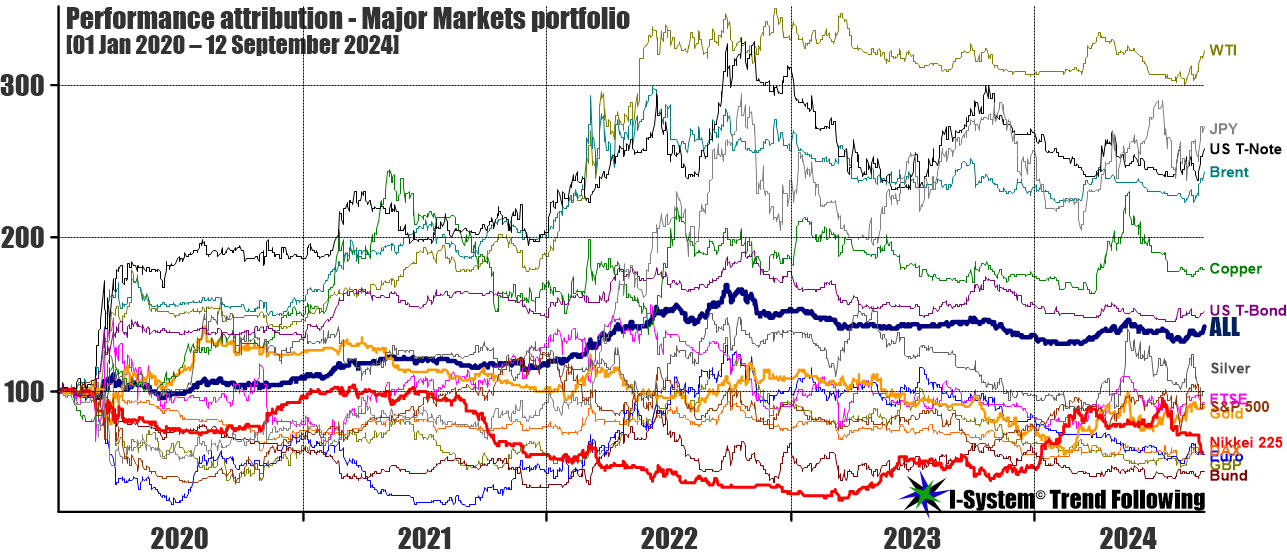

The chart below illustrates the performance attribution for each of the 15 markets included in the Major Markets portfolio (excluding Bitcoin) on an approximately equal risk-weighting basis:

There’s a lot to read into the above chart. For example, we can see the assymetry between the downside and the upside: while our negative performing markets (with the exception of German bund) are all above 50, the upside has reached above 300. We can also see that the ‘negative cohort’ are becoming more closely packed below breakeven.

Given that the above performance isn’t based on a backtest simulation, but on the signals communicated in real time since January 2020, they are the perfect illustration of the effectiveness of trend following. The strategy certainly requires a great deal of discipline and patience, but over the long term it is reliable and remarkably versatile, allowing investors to trade and profit in many markets even if they otherwise know little about them, both through bull and bear cycles.

A PDF report below details the performance of all 180 strategies in charts, through July 2024:

Again, the above performance review is the result of actual trading signals communicated to subscribers in real time – it is not a backtest simulation.

The benefits of I-System TrendCompass reports

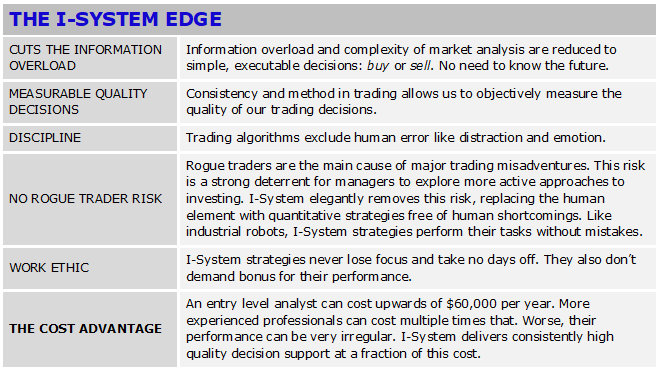

CUTTING THROUGH THE INFORMATION OVERLOAD

Financial industry generates thousands of research reports each and every day, an overwhelming glut of information. Instead of adding to your reading pile, we analyze market trends and deliver the final product of our research: clear, actionable decisions you can digest in seconds, not minutes per day.

REAL-TIME CTA INTELLIGENCE

For decades, commodities trading advisors (CTAs) have used systematic trend following as one of the best strategies in active investment trading. Institutions like Nomura, JPMorgan and Rabobank pay close attention to CTAs, because they appreciate that understanding CTA strategies “can provide a strong edge in today’s highly systematized markets.” TrendCompass delivers this edge – effectively, reliably and in real time!

PROVEN RELIABILITY, VERSATILITY AND EFFECTIVENESS

Our reports are generated by the I-System, the product of more than 20 years of passionate and uncompromising obsession with quality. We have tested its effectiveness in the most rigorous way possible: by managing real money portfolios and comparing their performance to that of the world’s leading “managed futures” funds or Commodity Trade Advisors (CTAs). Since the inception of our track record in 2007, I-System has consistently outperformed its benchmarks (audited).

INVALUABLE, TIMELY DECISION SUPPORT, EVERY DAY

A reliable and effective trends auto-pilot provides invaluable decision-support. Even only as a ‘reality check’ or a source of ‘second opinion’ to market analysts, TrendCompass gives you the guidance to navigate the markets profitably, confidently and with a peace of mind.

Screenshot of a typical I-System strategy for S&P500 shows up-trends in blue and downtrends in red. Onset of a down-trend is a signal to reduce or hedge your market exposure. It is equally important to know when to start adding to your exposure again. During the 2008 bear market, we achieved a 27% positive net return thanks to I-System strategies like this one. The authenticity of our results was audited by KPMG.

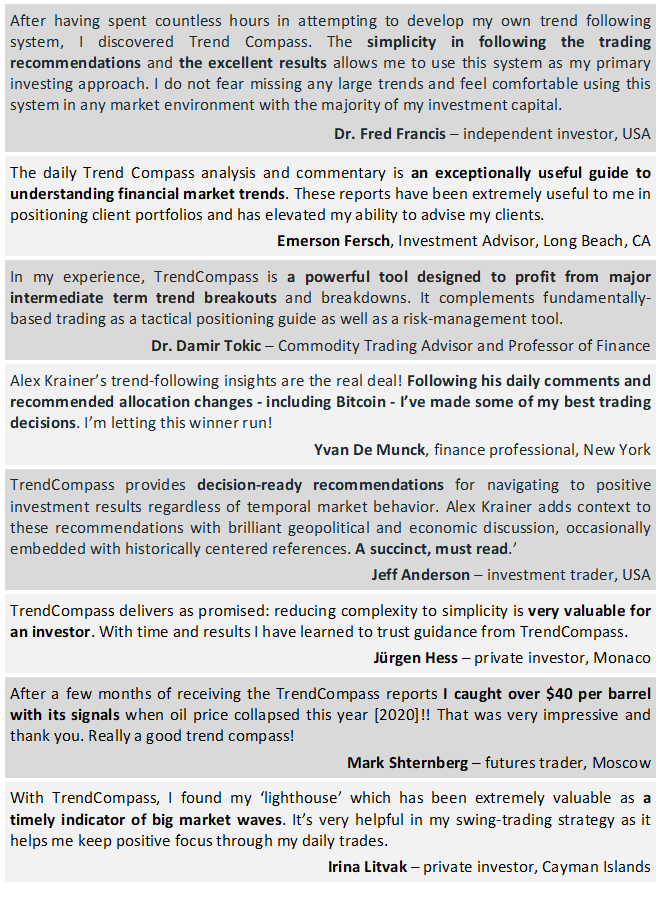

What some of our clients say…

Our clients enjoy the sober, consistent quality decision support they get from TrendCompass… Here are a few testimonials from professional and non-professional investors:

With a large set of well formulated, effective and thoroughly tested trading strategies and discipline you'll be able to navigate a wide range of financial and commodity markets with confidence and peace of mind, achieving lifelong success in managing your portfolio. While you’ll have to supply the discipline yourself, we provide top notch decision support, thanks to the I-System and the TrendCompass reports.

TrendCompass: what you get

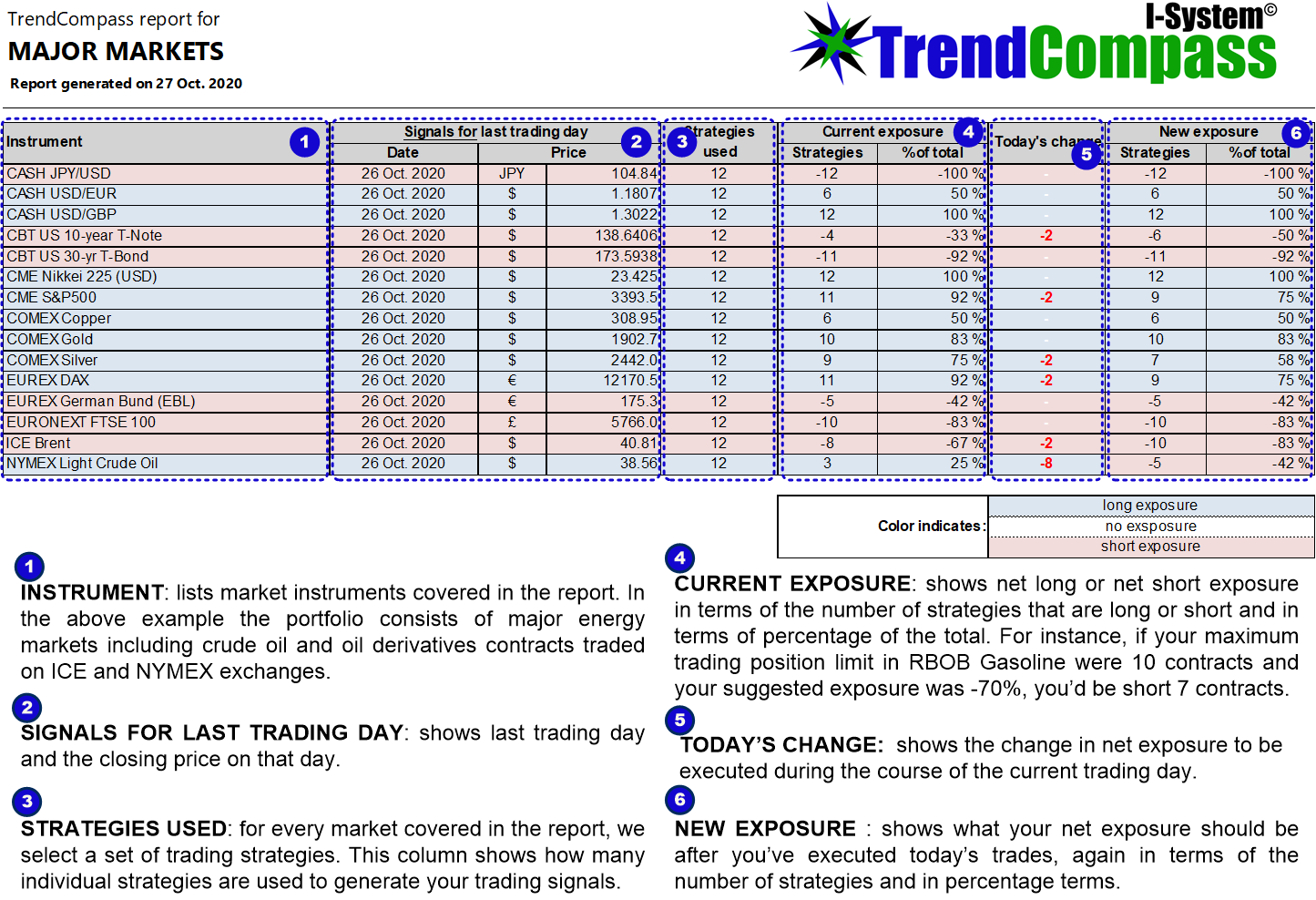

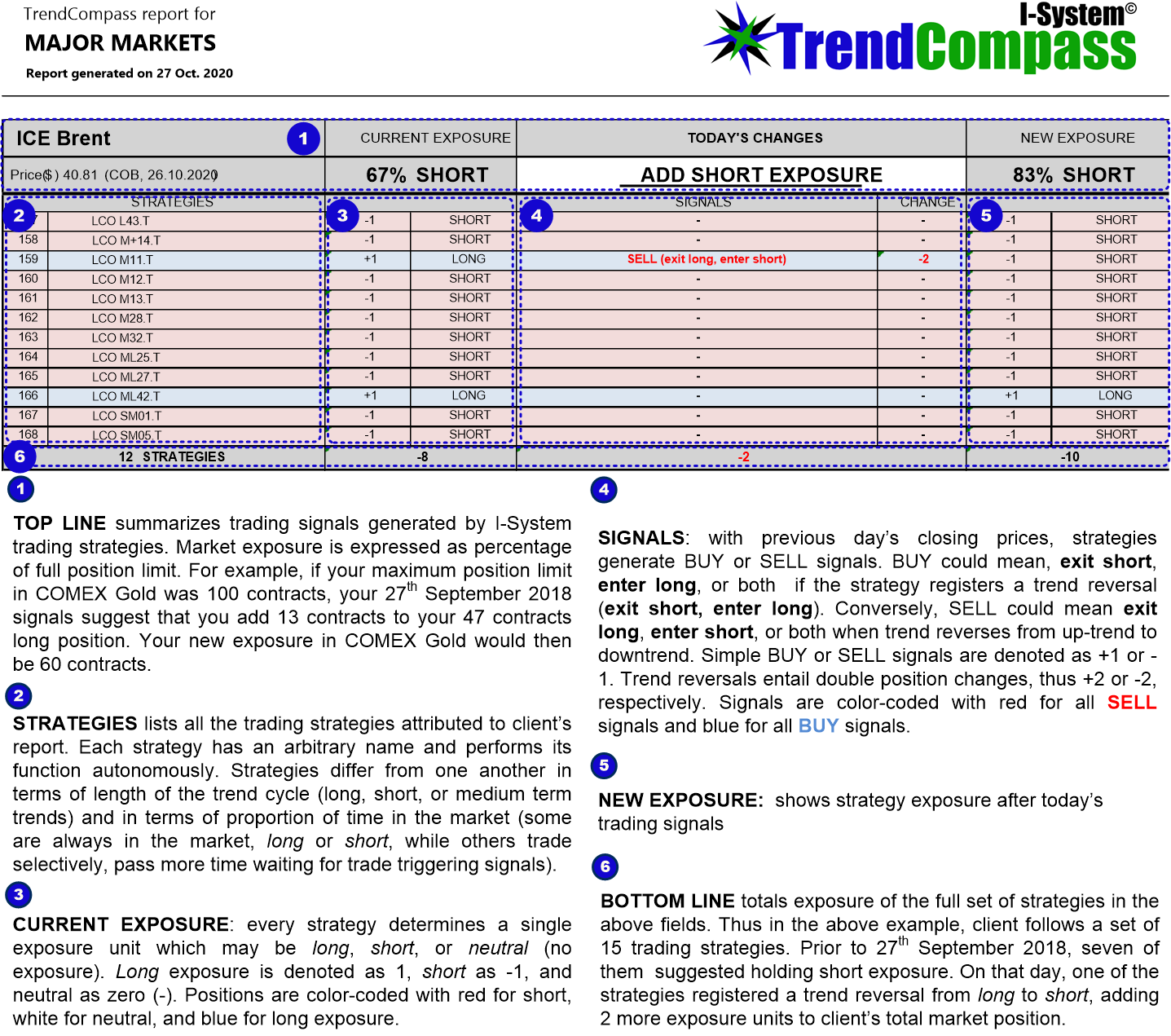

Without fail, TrendCompass will help you profit from major price trends. We worked hard to make our reports intuitive and easy to read so you can review them in just a few seconds each day. The reports consist of an e-mail with a very brief commentary, and a PDF containing a markets summary page followed by a detailed breakdown per market showing trading signals and/or trend reversals per each individual trading strategy.

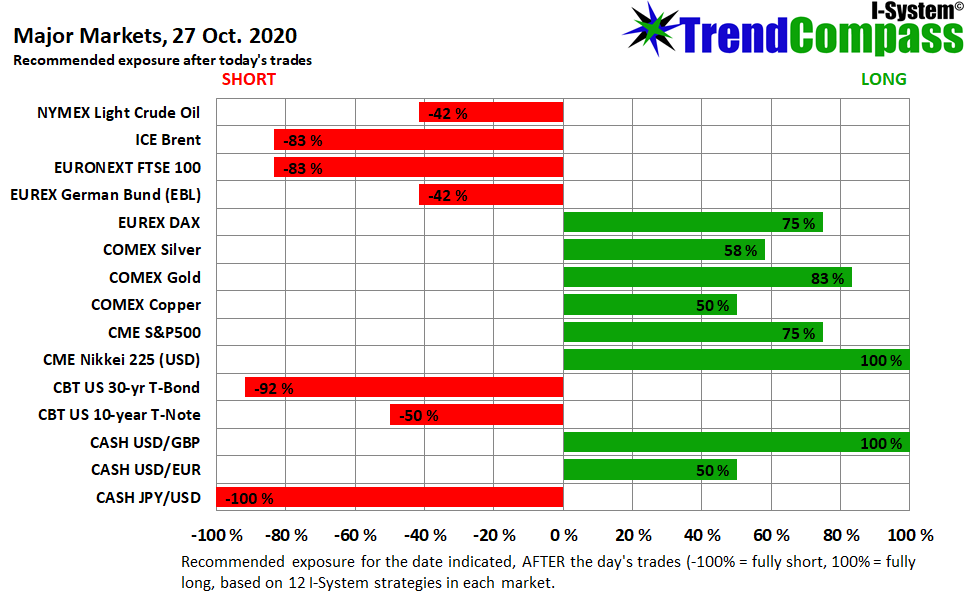

Daily e-mail summary

Your daily e-mail summarizes the changes in directional exposure based on previous trading session. An intuitive bar chart shows the recommended exposure so that you can grasp it at a glance.

PDF – summary page

PDF – detailed breakdown by market and by trading strategy

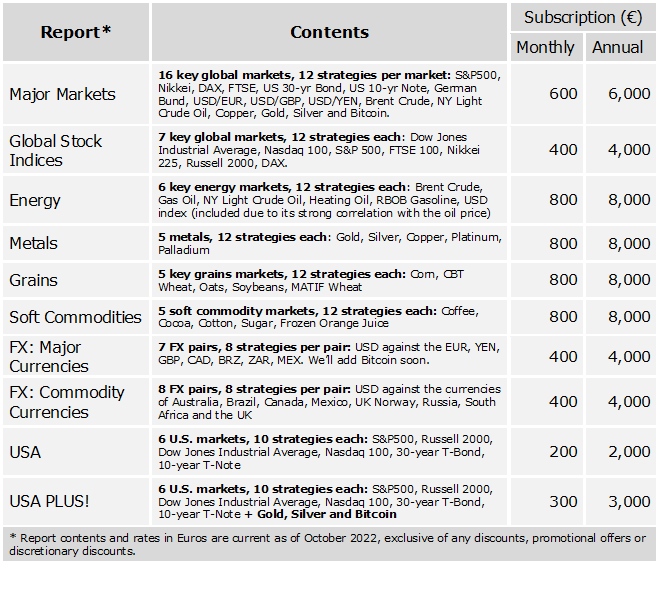

TrendCompass offers a variety of standard or customized market reports:

Subscription rates – standard reports

Available standard reports available and subscription rates (excluding any promotional offers or discretionary discounts) are listed below.

Customized portfolios

We can customize reports for clients who wish to track a different selection of markets, a larger number of strategies, or follow a particular selection of strategies (for example, a preference for short-cycle trends). We’ll seek to accommodate any such request. A one-time 1,200 Euros setup fee may apply for customized portfolios.

Subscribe now and receive a one-month free trial!

Systematic trend following entails disciplined adherence to predefined and time-tested rules. It helps investors and traders keep composure through the commotion of volatile market moments so they can navigate market trends profitably, with confidence and peace of mind!

One month’s test-drive is on us – no commitment or obligation on your part!

Free resources

My book “Mastering Uncertainty in Commodities Trading,” was rated #1 on FinancialExpert.co.uk list of “The 5 Best Commodities Books for Investors and Traders” for 2021 and 2022.

The “Trend Following Bible,” which covers much of the same curriculum, is more up to date (it was published in 2021) and probably a better text. Both are available free of charge at the above links.

You can also find my interview discussing trend following with Michael Covel of TrendFollowing.com at this link:

Episode 975: Alex Krainer Interview with Michael Covel on Trend Following Radio

Subscription terms

This SUBSCRIPTION AGREEMENT (AGREEMENT) is by and between KRAINER ANALYTICS or a company to be nominated subsequently (PUBLISHER) and the undersigned company or person (CUSTOMER). The EFFECTIVE DATE of the agreement will be the date when the customer requests to receive paid subscription service and upon expiration of the free trial period as evidenced by filled subscription form, e-mail request or acceptance of PUBLISHER’S invoice.

1. THE SERVICE: PUBLISHER produces and distributes TrendCompass reports (REPORTS) to which the CUSTOMER may purchase monthly or yearly subscription.

2. STANDARD REPORTS: PUBLISHER produces a variety of “TrendCompass” reports (REPORTS). For each market included therein, the REPORTS convey daily trading recommendations based on systematic trend-following strategies as generated by PUBLISHER’s proprietary I-SYSTEM technology. Such trading strategies are believed to be similar to those used by many Commodities Trading Advisors (CTA) or Managed Futures funds.

3. CUSTOMIZED REPORTS: in addition to, or in lieu of REPORTS specified herein, CUSTOMER may request a bespoke report according to CUSTOMER’s own requirements. The subscription to such reports may vary from those specified herein and their creation may involve an additional set-up fee that shall be borne by the CUSTOMER.

4. INTENT AND OBJECTIVE: The objective of REPORTS, whether standard or customized, is to provide the CUSTOMER guidance as to the likely activities of CTA investment funds which are believed capable of influencing price fluctuations in many markets. CUSTOMER acknowledges that REPORTS do not purport to accurately reflect such funds’ activities but rather represent an approximation of their trades based on the technology which is proprietary to PUBLISHER and is believed to be similar and correlated to models used by many CTAs. By accepting this agreement the CUSTOMER expressly acknowledges that REPORTS constitute a form of supplemental decision support and in no event shall they be deemed as an inducement to trade. The CUSTOMER further acknowledges having sufficient experience in trading the markets included in REPORTS to which the CUSTOMER may subscribe and awareness of risks inherent in trading in such markets.

5. DELIVERY: To the best of PUBLISHER’s ability, REPORTS shall be delivered to the CUSTOMER each working day (Monday through Friday) by e-mail in PDF format or other suitable format.

6. NO REDISTRIBUTION: CUSTOMER acknowledges and agrees that the REPORTS constitute proprietary and confidential information of substantial value to PUBLISHER and shall not redistribute, reproduce, retransmit, disseminate, sell, publish, broadcast, or circulate all or any portion of any report to any third party except with and according to express permission as requested from and granted by PUBLISHER for a stated, limited purpose and as witnessed in writing. Any such redistribution will include a proper copyright notice reading, substantially, as follows: “Source: KRAINER ANALYTICS (or TBN)” Such notice shall be placed immediately adjacent to the published content in a reasonably legible font size. CUSTOMER may not make or permit any alterations to any reproduced materials or any portion of REPORTS unless expressly agreed to by PUBLISHER.

7. FREE TRIAL PERIOD: The EFFECTIVE DATE of this AGREEMENT follows a discretionary free trial period afforded by PUBLISHER to the CUSTOMER in order to better appreciate the nature of REPORTS CUSTOMER subscribes to. Normally, this period shall encompass a two week period from the commencement of daily delivery of REPORTS, normally consisting of ten daily reports. Upon the acceptance of this AGREEMENT, the free trial period ends and subscription fees become due to PUBLISHER from the EFFECTIVE DATE onward.

8. FEES: Subscription fees for each standard REPORT to which CUSTOMER subscribes are set forth herein. Fees for customized report will be determined and communicated based on CUSTOMER’s requirements.

9. PAYMENT: The fees are due and payable within one calendar month from the EFFECTIVE DATE against and in accordance to invoices issued by PUBLISHER to the CUSTOMER. If any PUBLISHER invoice is issued in error, CUSTOMER will promptly contest such errors and request an amended invoice. Unless an invoice is contested on valid or reasonable grounds, CUSTOMER’s failure to timely pay the fees as invoiced by PUBLISHER shall entitle PUBLISHER to halt delivery of further REPORTS. Failure to pay the fees within 30 days from the invoice date shall entitle PUBLISHER to terminate this AGREEMENT.

10. TERM AND TERMINATION: Except for termination for non-payment of fees by CUSTOMER or material breach of any term or condition to this AGREEMENT by either party, this AGREEMENT is valid for 12 months from the EFFECTIVE DATE and will renew automatically unless either PUBLISHER or CUSTOMER terminates the AGREEMENT. PUBLISHER reserves the right to terminate this agreement 12 months from the EFFECTIVE DATE by giving a 30 day termination notice to the CUSTOMER. The CUSTOMER may terminate the AGREEMENT by giving a 30 day cancellation notice to PUBLISHER. Termination of services under this AGREEMENT shall be without limitation as to any other rights or remedies of the terminating party.

11. DATA INTEGRITY: REPORTS are based on and depend on price data PUBLISHER obtains from data providers that PUBLISHER believes to be reliable, but PUBLISHER does not guarantee the accuracy, completeness, or availability of such data. Such price data is published by clearinghouses of various global securities exchanges and may from time to time contain errors. Corrections of data errors are regularly published by exchange clearinghouses and such corrections may on occasion retroactively change the trading recommendations communicated in the REPORTS.

12. DISCLAIMER: REPORTS are provided “as is.” For itself or on behalf of its data and service providers, PUBLISHER hereby disclaims all warranties, express and implied, including without limitation all warranties of suitability, fitness for a particular purpose, merchantability, non-infringement, and any warranty arising out of course of dealing. Neither PUBLISHER nor any of its service providers shall be liable for any indirect, incidental, special or consequential damages (including lost profits) incurred in connection with this AGREEMENT or arising out of or relating to the REPORTS, even if A has been advised of the possibility of such damages. CUSTOMER agrees that in no event will the total aggregate liability of PUBLISHER for any claims, losses, or damages arising under this AGREEMENT whether in contract or in tort, including negligence exceed the total amount of fees actually paid by CUSTOMERE to PUBLISHER for the REPORT(S) during the term of the AGREEMENT with respect to which the claim may arise.

13. INDEMNIFICATION: CUSTOMER shall at its expense, indemnify, defend, and hold PUBLISHER harmless from and against any and all claims, losses, liabilities, damages, actions, proceedings, costs, and expenses (including without limitation reasonable attorneys’ fees) arising out of or relating to CUSTOMER’s use of the REPORTS. PUBLISHER shall notify CUSTOMER promptly in writing of any claim with respect to which it seeks indemnification from CUSTOMER pursuant to the foregoing.

14. ENTIRE AGREEMENT: This AGREEMENT constitutes the entire agreement of the parties relating to the subject matter hereof, and all prior agreements, written or oral, shall be deemed to be superseded by this AGREEMENT. No waiver, alteration, or modification of any of the provisions hereof shall be binding unless in writing and signed by authorized representatives of PUBLISHER and CUSTOMER.

15. ASSIGNMENT: CUSTOMER shall not assign this AGREEMENT or delegate any rights or obligations hereunder without the prior written consent of PUBLISHER and any attempted assignment by CUSTOMER in violation of the foregoing shall be void and of no effect.

16. AGENCY: Nothing in this AGREEMENT shall be deemed to create an agency, joint venture, or partnership relation between PUBLISHER and CUSTOMER. Neither party shall have authority to act on behalf of or bind the other party in any way. The invalidity, illegality or unenforceability in any respect of one or more of the provisions of this agreement shall in no way affect or impair the validity, legality or enforceability of the remaining provisions which shall continue in full force and effect. This AGREEMENT may be executed in multiple counterparts, each of which shall be deemed to be an original, but all of which together shall constitute one and the same instrument.

17. NOTICES: Notices pursuant to this AGREEMENT may be given by e-mail or by post. Facsimile signature will be deemed original signatures.

18. JURISDICTION: This AGREEMENT shall be governed by the laws of the Principality of Monaco